Five or Six years back, people are noticing there are quite a few of Fintech companies started to offer no/very low commission stock/ETF trading.

I am not talk about the business model to make money on the pricing (difference between market maker price and the real price you get from App). I believe Robinhood and similar company had trouble with that model (lawsuits, SEC fines and so on).

I do not think I can cover all the tricks they are using. but I would like to show at least one. Here is a computing model that many firms use to cut cost and provide end user good experience, such as best market maker price.

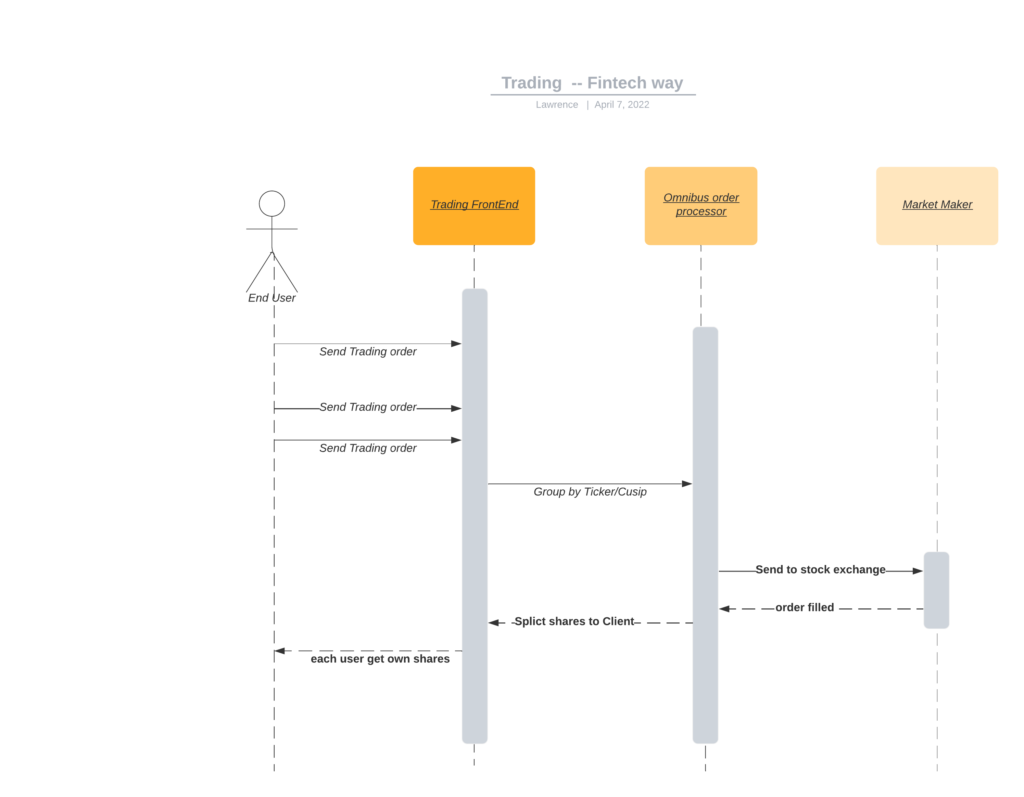

Let me show the workflow first:

- Usually, Fintech companies execute your order in a timed window, such as 10AM EST, 1PM EST and 3PM EST. They call it “Trading Window”. Lets say, there are 100 users want 1 share of AMZN each. you may not get best price for purchasing just 1 share. so lets group it together.

- Once all the grouped market order is ready to execute, then send it to Market Maker as one big buy/sell order. FYI, it also cut cost to use FIX trading protocol.

- Once the order fulfilled, it is time to split the big chunk into small pie and assign to each end user.

- Repeat the process again on different trading Window.

Suppose you sign up an start up fintech to use DCA approach, each paycheck invest $500 with a diversified portfolio. if you trade individually, you may get just a small fraction for each Stock/Ticker in your portfolio. But this method can significantly reduce the overhead to reach out Market Maker. it can pool all the $500 cash together and figure out a trade plan, right?